Common Mistakes to Avoid in Real Estate Investing: Navigating the Terrain with Wisdom and Foresight

Investing in real estate can be an exciting venture that promises income and wealth growth. But the road to success is fraught with potential pitfalls that can plague even the most seasoned investor. Based on personal experience and careful analysis of the real estate environment, this article aims to reveal common mistakes to avoid. It offers a collection of insights, anecdotes and practical advice to help both novice and experienced investors.

One. Ignoring Due Diligence: Costly Oversight

One of the cardinal sins of real estate investing is neglecting due diligence. The excitement of a potential transaction can sometimes overshadow the importance of thorough research and understanding of the property, location and market trends. I vividly recall the experience of a colleague who had a seemingly promising investment turn into a nightmare due to unexpected zoning issues. The lesson here is clear. Thorough research is the foundation of any successful real estate business. 2. Ignoring Market Trends: The Crystal Ball Dilemma.

Predicting market trends is like looking into a crystal ball and it’s useless. However, some investors fall into the trap of making decisions based on short-term market movements or overly optimistic forecasts. A closer look includes understanding broad economic indicators, local demographics and the region’s long-term growth potential. Market volatility is unpredictable, but a thorough understanding of fundamentals can be a reliable compass.

Three. Ignoring the exit strategy: a strategic mistake

Investing in real estate without a clear exit strategy is like swimming aimlessly. Investors often get caught up in the buying phase and end up forgetting how to liquidate their investments or plan capitalization. Whether you’re relocating, renting or investing for the long term, it’s essential to have a well-thought-out exit strategy. Through my experience, I’ve learned how important it is to keep the endgame in mind from the start and make sure every decision aligns with the end goal. 4. Underestimating hidden costs: the budget quagmire.

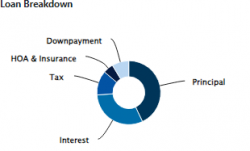

Real estate transactions are notorious for hidden costs that can quickly get out of hand. From maintenance costs to unexpected repairs, the reduction in the real value of your real estate investment can threaten its profitability. An investor friend once warned me about a renovation project that was facing financial difficulties due to unexpected structural problems. Most importantly, your budget is conservative and always provides a financial safety net.

5. Emotional Decision Making: The Investor’s Achilles’ Heel

Emotions are the essence of the human experience, but they have no place in the world of real estate investing. Making investment decisions based on emotion, such as fear of getting into or losing money in real estate, can lead to unfortunate results. My real estate journey has taught me the importance of maintaining a rational and dispassionate perspective. Watch the numbers, follow the strategy and make investment decisions based on logic, not emotion. Conclusion: Navigating the complex tapestry of real estate

Real estate investing is a complex tapestry full of opportunities and challenges. By learning from the mistakes of others and taking a strategic and informed approach, investors can navigate the sector with wisdom and foresight. The anecdotes, insights and practical advice shared here are not just theoretical principles. It is the product of real life experiences that have shaped a successful real estate journey. As you begin your investment endeavors, remember that knowledge, dedication and humility can be your most valuable partners in the dynamic world of real estate.

https://www.nananke.com/profile/prestigesouthern/profile

https://www.foxyandfriends.net/profile/prestigesouthern/profile

https://u-ssr.com/prestigesouthern

https://candfans.jp/FYUBVHj671mSXGM

https://geotimes.id/author/prestigestar/

https://direct.me/treerainplan

https://www.fundable.com/user-829060

https://www.pubpub.org/user/mia-isabella-parker

https://www.twine.net/treerainplan/about

https://data.world/treerainplan

https://www.pexels.com/@mia-peter-854263639/

https://pixabay.com/users/treerainplan-41358898/

https://www.reddit.com/user/treerainplan

https://gravatar.com/treerainplan

https://www.tumblr.com/prestigeraintreeparkreview

https://www.crunchbase.com/organization/prestige-raintree-park-ongoing

https://www.zillow.com/profile/treerainplan

https://www.twitch.tv/treerainplan- India@108@12

https://social.msdn.microsoft.com/Profile/Mia%20Taylor

https://unsplash.com/@treerainplan

https://www.chaloke.com/forums/users/prestigestarss/

https://www.betting-forum.com/members/prestigestarss.41408/#about

https://www.anibookmark.com/user/prestigestarss.html

https://gitlab.vuhdo.io/prestigestarss

https://macro.market/company/prestige-southern-star

https://alumni.cusat.ac.in/members/prestigestarss/profile/

https://dtf.ru/u/1437637-rose-taylore

https://participez.nouvelle-aquitaine.fr/profiles/rose_taylore/activity