Income-generating rental properties for investors

Income-generating rental properties are a lucrative investment option for individuals seeking to diversify their portfolio and generate passive income streams. These properties, typically residential or commercial real estate units, are acquired with the intention of leasing them out to tenants in exchange for regular rental payments. This model provides investors with a consistent cash flow while also allowing for potential appreciation in property value over time.

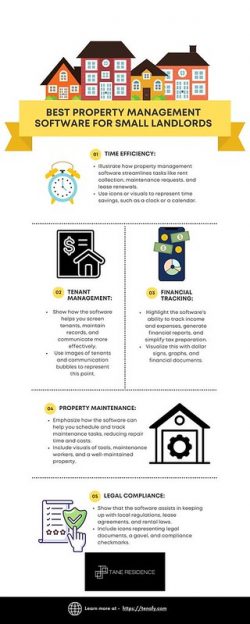

One of the key attractions of income-generating rental properties is their ability to produce reliable income without requiring active involvement in day-to-day operations. Once the property is acquired and tenants are in place, the investor can enjoy a steady stream of rental income while property management companies handle the ongoing maintenance and tenant relations. This passive income stream can be particularly appealing to individuals looking to supplement their primary source of income or secure their financial future through long-term investments.

Rental properties offer investors several advantages over other investment vehicles. Firstly, they provide a hedge against inflation, as rental prices tend to increase over time in line with the cost of living. Additionally, rental properties offer tax benefits such as depreciation deductions, mortgage interest deductions, and the ability to defer capital gains taxes through 1031 exchanges, which can significantly enhance the property’s overall return on investment.

Moreover, income-generating rental properties offer investors the opportunity to build equity over time through mortgage principal paydown and property appreciation. As the property’s value increases and the mortgage balance decreases, the investor’s equity stake in the property grows, thereby increasing their net worth and overall financial stability.

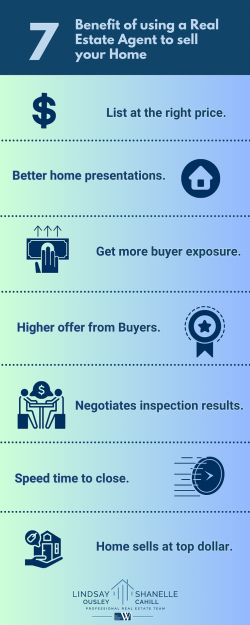

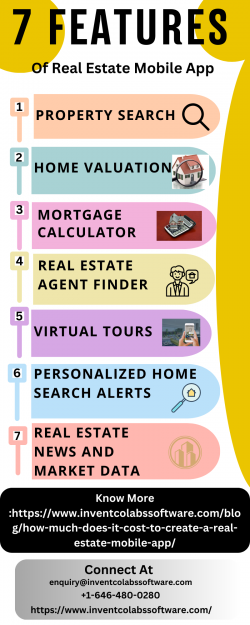

When selecting income-generating rental properties, investors should conduct thorough due diligence to ensure the property aligns with their investment goals and risk tolerance. Factors to consider include location, rental market demand, property condition, potential for rental income growth, and overall investment returns. By carefully evaluating these factors and conducting comprehensive financial analysis, investors can identify properties with strong income-generating potential and minimize the risk of investment loss.

In conclusion, income-generating rental properties represent an attractive investment opportunity for investors seeking to generate passive income, build wealth, and diversify their investment portfolio. With the potential for steady cash flow, tax benefits, and long-term appreciation, rental properties offer investors a path to financial freedom and security. By making informed investment decisions and actively managing their rental properties, investors can unlock the full potential of this rewarding asset class.

https://purvaaerocitys.bravesites.com/

https://www.blogtalkradio.com/purvaaerocitys

https://mixi.jp/show_profile.pl?id=68486097&from=account_menu

https://speakerdeck.com/purvaaerocity

https://www.codecademy.com/profiles/purvaaerocity

https://infogram.com/purva-aerocity-1hxj48m591po52v

https://www.manta.com/c/m1wfg05/purva-aerocity

https://www.eventbrite.com/o/prestige-rock-cliff-80747915263

https://unsplash.com/@prestigerockcliff

https://www.imdb.com/user/ur178751922/?ref_=nv_usr_prof_2

https://www.tripadvisor.com/Profile/prestigerockcliff

https://rfu6znzq32m.typeform.com/to/BIIEPsZS

https://ameblo.jp/prestigerockclifff/entry-12844386630.html

https://www.youtube.com/@PrestigeRockClifff

https://profile.typepad.com/psouthernstar

https://gamejolt.com/@prestigesouthernstar

https://tapas.io/prestigesouther322

https://wefunder.com/prestigesouthernstars

https://reallygoodemails.com/u/prestigesouthernstar

https://www.energysage.com/profile/

https://www.eventbrite.ie/o/prestige-southern-star-79670032533

https://www.patreon.com/posts/discover-luxury-100409909?utm_medium=clipboard_copy&utm_source=copyLink&utm_campaign=postshare_creator&utm_content=join_link

https://www.slideshare.net/slideshows/prestige-southern-star-begur-your-gateway-to-luxury-living/266802213

https://scratch.mit.edu/users/psouthernstar/

https://www.drupal.org/u/prestige-southern-star

https://www.fiverr.com/prestigesouthes

https://www.shutterstock.com/catalog/collections/3324398900927792608-f6795c50aebf61cafd5289750417054cd650fe63082793f3ed67f7474cb2ee75

https://linktr.ee/prestigerockclifff

https://archive.org/details/prestige-rock-cliff-is-a-splendid-state-of-the-art-residential-venture-located-i

https://www.patreon.com/posts/discover-luxury-100395923?utm_medium=clipboard_copy&utm_source=copyLink&utm_campaign=postshare_creator&utm_content=join_link

https://gravatar.com/reviewprestigerockcliff

https://botitmobal.wixsite.com/qzstmq/profile/prestigerockcliff/profile

https://form.jotform.com/240742649960060

https://sway.cloud.microsoft/EgINsCIDIBS1Kyoj?ref=Link

https://botitmobal.wixsite.com/qzstmq/profile/aerocitypurva/profile

https://www.liveinternet.ru/users/purvaaerocitys/profile

https://www.eventbrite.ie/o/purva-aerocity-80810449963

https://themepalace.com/users/purvaaerocity/

https://botitmobal.wixsite.com/qzstmq/profile/aerocitypurva/profile

https://developer.cisco.com/user/profile/ad3fd1ab-ec04-5dce-90ba-201f75c7d203

https://www.notion.so/Purva-Aerocity-Redefining-Residential-Living-in-North-Bangalore-57ba028bac0b42269a0abd8d7562add2?pvs=4

https://purvaaerocitys.splashthat.com/

https://orell31.narod.ru/index/8-16971

https://community.clover.com/users/44545/purvaaerocity.html

https://pastebin.com/u/purvaaerocitys

https://link.shutterfly.com/CzjNBvge0Hb

https://habr.com/en/users/purvaaerocitys/

https://www.threadless.com/@purvaaerocitys

https://support.mozilla.org/en-US/user/prestige_rock_cliff/

https://nationaldppcsc.cdc.gov/s/profile/0053d000004FCOkAAO

https://no.tripadvisor.com/Profile/prestigerockcliff

https://www.pinterest.ca/prestigerockclifff/

http://evasion.nantes.free.fr/index.php?file=Members&op=detail&autor=prestigerockcliff

https://prestigerockcliff.jimdosite.com/

https://www.slideshare.net/slideshows/prestige-rock-cliff-where-luxury-meets-serenity-in-banjara-hills/266814067

https://meta.stackexchange.com/users/1465151/prestige-southern-star

https://www.notion.so/Prestige-Southern-Star-7edfc44abfc84e218a39cb0ffa1886a7?pvs=4

https://about.me/prestigesouthernstars

https://prezi.com/i/bfatdisqrtiz/

https://prestigesouthernstars.nethouse.ru/

https://www.pixiv.net/en/users/104351605

https://www.virustotal.com/gui/user/prestigesouthernstar