Require Business advisory services

‘Structure’ means the arrangement of the various parts. ‘Capital’ in the world of business, means money. Capital structure implies the arrangement of capital from different sources so that the long-term funds needed for the business are raised. It is a way that a business finances its operations, the money used to buy inventory, pay rent, and other things that keep the business’s doors open. It is the combination of debt and equity used by company to finance its overall operations and growth. A business management team and stakeholders will consider the proper mix of debt and equity for their ideal capital structure. Debt comes in the form of bond issues or loans, while equity may come in the form of common stock, preferred stock, or retained earnings. Short-term debt is also considered to be part of the capital structure. Debt contains of borrowed money that is due back to the lender, commonly with interest expense. Equity contains of ownership rights in the company, without the need to pay back any investment, equity allows outside investors to take partial ownership in the company and is more expensive than debt, especially when interest rates are low. The debt and equity can be found in the balance sheet. Company assets are also listed on the balance sheet, are purchased with this debt and equity. Capital structure can be a mixture of a company’s long-term debt, short term debt, common stock, and preferred stock. A company’s proportion of short-term debt versus long-term debt is considered when analyzing its capital structure. It is worthy to note that capital structure is different from financial structure and a company’s ideal capital structure will depend on its situation, including factors like the cost of capital, the business cycle, and any existing debt or equity.

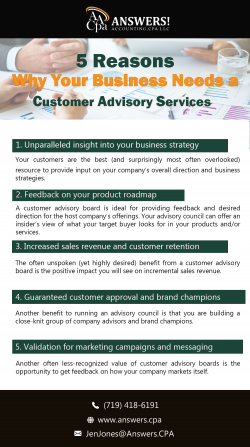

Business advisory services aim at strategizing for the growth and expansion of the business. The focus is on the future aids progress, and it includes the development of innovative and comprehensive solutions according to the customer’s business needs. The objective is to bring more focus on value proposition by giving advisory services such as accounting advisory services, Financial Modelling, Business Structuring. Business advisory services handle the important areas and technical aspects of the business to help the business to grow to its fullest extent. Advisors are a group of five to six people able to provide all the necessary information for the growth and success of the organization in every field. The advisors are appointed as business coaches, mentors and accountants. Examining previous events and comparing them with the forecasts. The work of an advisor is not a defined to one business function.