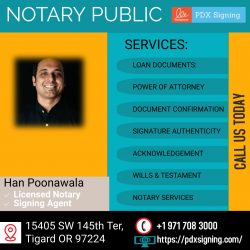

Loan signing agent

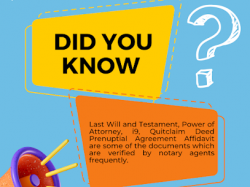

During a loan signing, also known as a mortgage signing, the borrower signs the necessary papers to finish a mortgage loan transaction. A notary loan signing agent is a notary public who has received specialised training and authorization to handle loan signing papers. It is the notary signing agent’s duty to supervise the signing of the documents and ensure that the borrower is acting freely and without coercion.

The general steps in a loan signing, as a Notary Signing Agent, are as follows:

1. Verify the borrower(s)’ identity as required by your jurisdiction’s notary requirements. This is often accomplished by looking at the borrower’s official photo ID.

2. Verify that all of the loan documentation is accurate and full.

3. Respond to the borrower’s questions and go over the paperwork with them. Although the Notary Signing Agent might not be qualified to provide legal advice, they should be able to answer basic questions about the documentation.

4. Request that the borrower(s) sign the documents in the presence of the Notary Signing Agent. The notary signing agent will next have the borrower sign the papers in their presence, and if necessary, will also provide a notarized certificate of acknowledgment.

5. Ensure that every signature is gotten and that the documents’ copies are made in line with the rules.

6. Return the original, signed documents in accordance with the guidelines provided.